Felicis backs founders building iconic companies and we invest directly in their growth to make them unbreakable. A large part of my role as Talent Partner is to invest in our founders by helping them to see around corners and scale their success through their functional leaders.

When companies are small, it’s easier for founders to define and reach the right outcomes through 1:1 interactions and quick iterations. As companies scale, it becomes more difficult to reach the necessary outcomes through those same interactions and iterations - the needs of the business become more complex. To be successful, founders must prioritize a strong executive bench that can deliver the right outcomes at every stage of scale.

A highly effective bench requires founders to understand the necessary outputs of these functional leaders at every level of growth. Founders must also objectively identify when a company is scaling past the expertise of its existing functional leaders and understand the profiles that are motivated by, and capable of delivering on these evolving requirements for success. This can be especially challenging for founders.

To support founders on this journey, we gathered data on the executive benches of 30 outlier companies over the last decade at each funding round. And further, we married that data with a map of the evolving expectations by function to help founders see around corners and better enable them to build a bench that accelerates or supports growth at every scale.

Methodology

We started by defining a list of 30 outlier companies over the last decade; “outlier” being defined by a successful IPO and market cap of >$5b or a private company with a valuation of >$5b (list in appendix). We then spent over 300 hours researching and verifying the publicly available People/Title/team data and fundraising data to identify the most senior leaders across each function at each round of funding. We leveraged secondary data found on Crunchbase, Pitchbook, Backlinko, AngelList Talent, Craft, LinkedIn, LinkedIn Insights, company blogs and press releases.

What we found, at a glance

- Early sales leaders were very unlikely to scale a company - most C level executives were hired around Series C and were replaced before IPO

- Technology functions were the earliest to have a C-level executive (although, usually a founder), the most likely to have an early C-level executive that scaled through various rounds, and the most likely to have a C level at later stage without public company experience

- Finance functions hired a “Head of Finance” around Series A. The first CFOs joined around Series C and were extremely unlikely to be promoted into the CFO role, not at all likely to scale, and required the most public company expertise at later stage and/or time of IPO

- C-level People leaders appeared the most likely to scale from mid-stage through IPO, most likely to be promoted internally, and usually replaced an early manager or Head of who joined at or around 50 employees

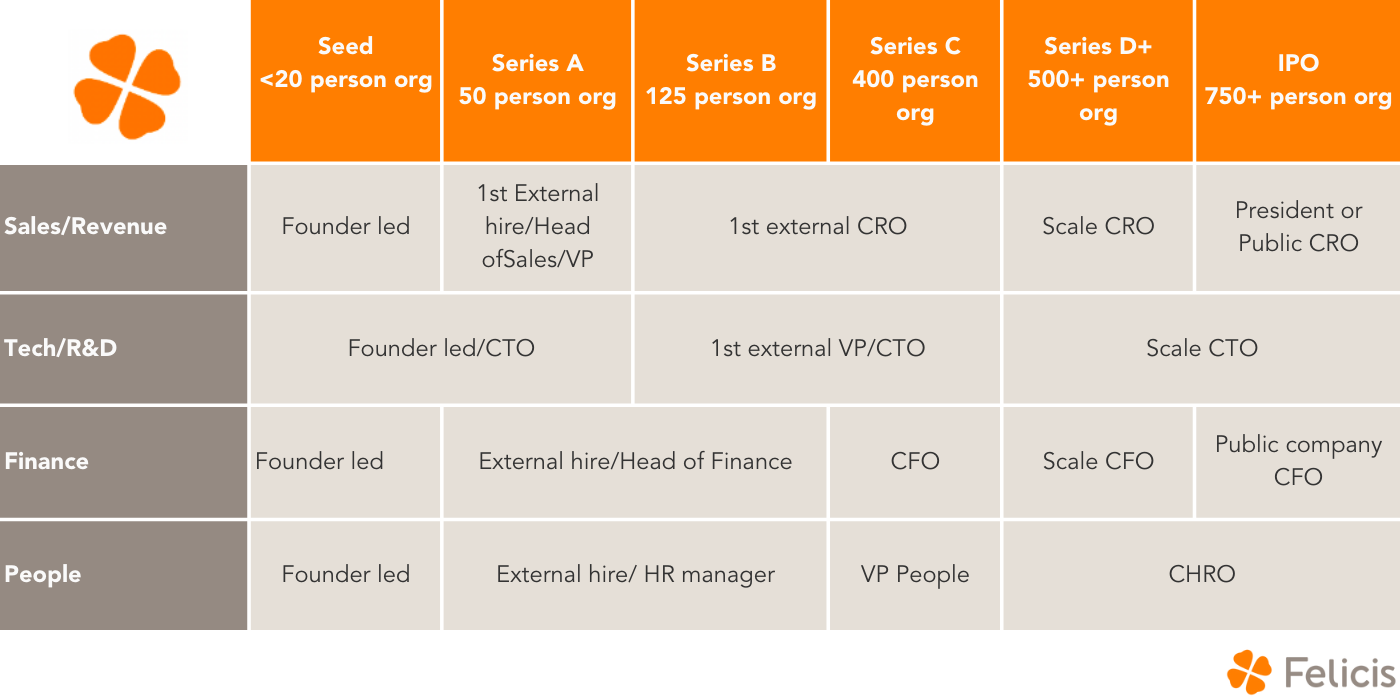

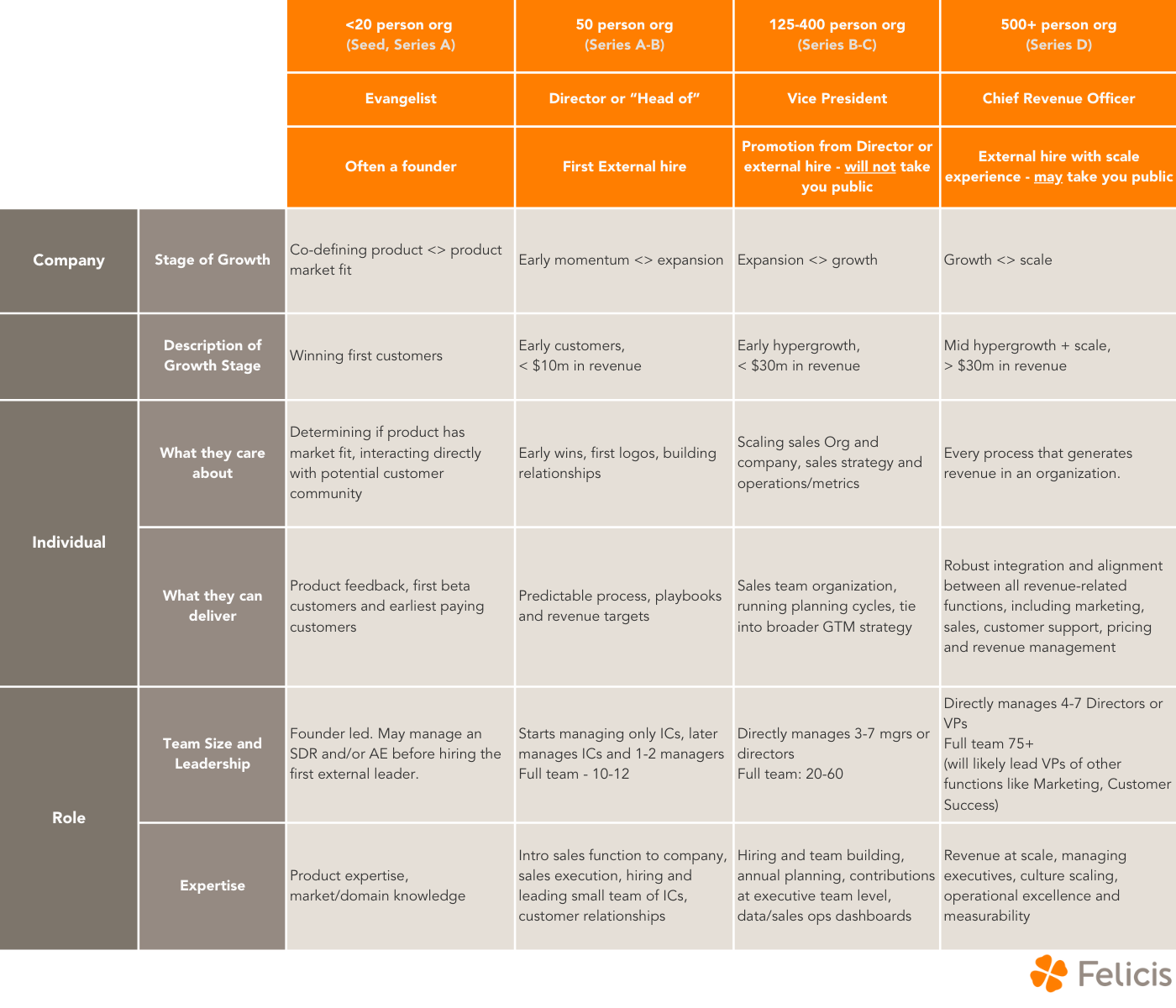

How this may look in practice

(This is directional and not a one-size-fits-all representation)

Sales/Revenue

- 40% of companies hired their first true CRO at Series C or D and had a VP or “head of” prior.

- 90% of Series C sales leaders were replaced or leveled before IPO (out of 21 publicly traded companies)

- 100% of companies who had a C-level sales executive before Series B replaced that executive with a more seasoned C-level or President by Series C.

- 0% of the Series B sales leaders were still the head of the function by IPO or Series E (80% of the companies on the list that reached IPO or Series E)

- In only 1/30 a CRO was promoted from a more junior role - this happened post IPO

- Director of sales is the most common title for functional sales leaders before Series B, VP is the most common title at Series B and C, CRO is the most common title at Series D

- Most sales functions are founder led before Series A

The biggest takeaway here is that early sales leaders are very unlikely to scale a company through IPO so it’s important for founders and executives to recognize the challenges that come at scale and what sales leaders should be able to deliver at each stage of growth.

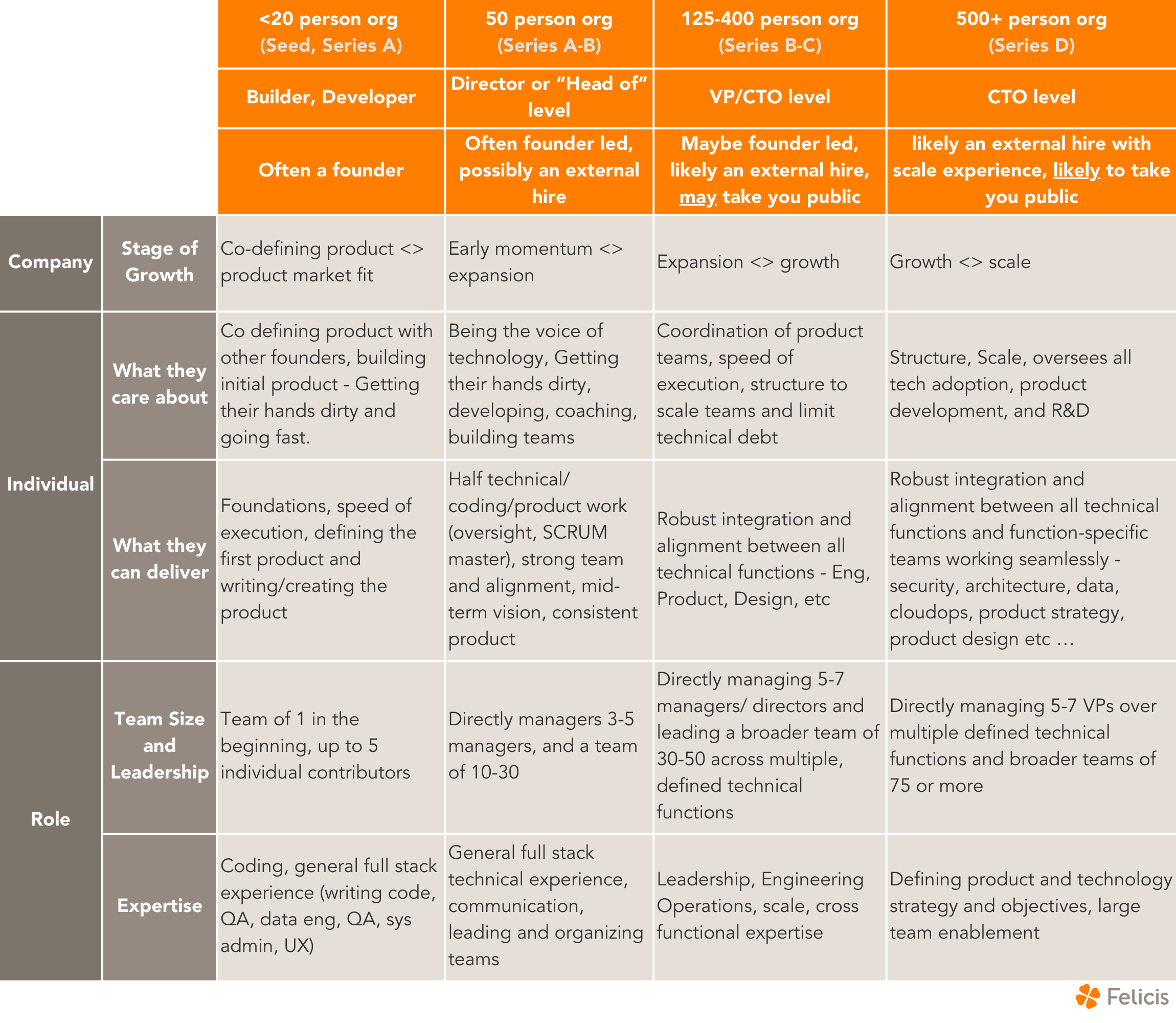

How this may look in practice

(This is directional and not a one-size-fits-all representation)

Technology/R&D

The technology function was among the earliest to have a c-level executive and also the most likely to have an early C-level executive that scales longer.

- All technology functions are founder led before Series A

- Almost 50% of the companies hired a non-founder VP Eng or CTO at Series A

- 23% hired an external C-level technology executive at Series C and either had a founder led Engineering function or a VP of Engineering until then

- 65% hired the CTO that took them public or through their latest funding round at Series D or beyond

- About 10% of these companies promoted a VP Eng to CTO around Series B, but none of those internal promotions remained as CTO at time of IPO.

The biggest takeaway here is that a founding technology leader will likely have a C- title and scale for a while, but the earliest leaders are unlikely to take a company public as the senior most technology leader. In speaking with early CTOs, it seems that external technical advisors or Engineering Operations can supplement an early CTO on the less technical aspects of running an Engineering org for much longer than in a Revenue generating function.

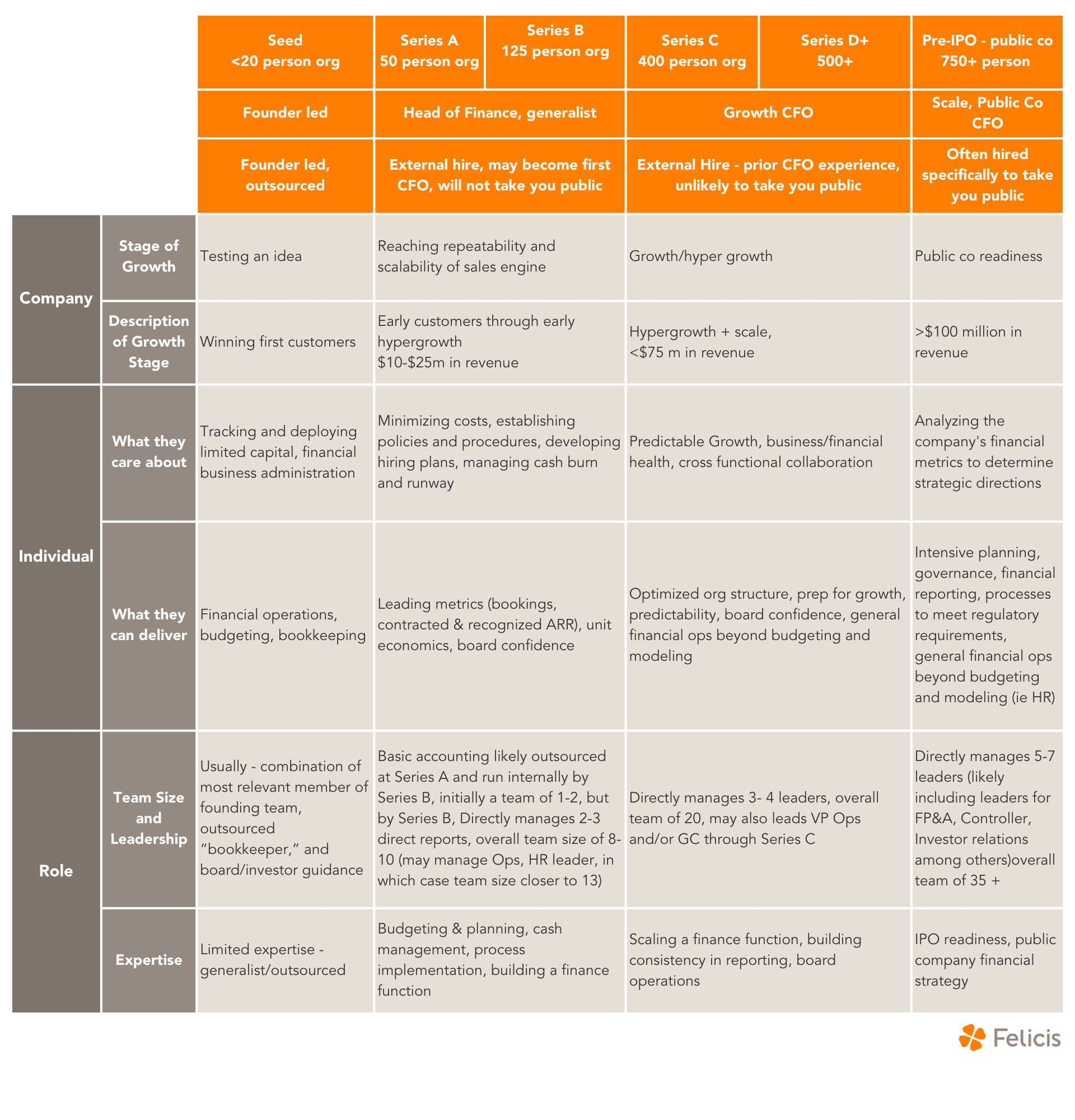

How this may look in practice

(This is directional and not a one-size-fits-all representation)

Finance

Surprisingly, the CFO is a later hire - most often around Series C. Unsurprisingly, early CFOs are extremely unlikely to be promoted into the CFO role, extremely unlikely to scale and seem to require the most public company expertise at later stage and/or time of IPO.

- 40% of companies did not have a formal CFO until Series C or beyond

- 100% of companies who had a CFO in place by Series C replaced that CFO before IPO

- At just under 10% of companies, a VP of Finance was promoted to CFO but in all of those cases that person was replaced with an external CFO before Series D

- Almost 80% of companies had a VP in place by Series B, 20% had a “head of” or VP at Series A

- 90% of companies had a CFO who had taken a company public or worked at a publicly traded company in a VP or C-level role before, at the time of IPO or post Series E.

The most obvious takeaway is that most companies prioritized a finance hire from early days, but these early leaders were extremely unlikely to scale through IPO and public company experience or experience taking a company public was prioritized in most cases. That said, a “senior” finance leader was in place fairly early, by series A or B, suggesting that outlier companies placed importance on the finance function in early days and may have positively benefited from prioritizing this skill set early.

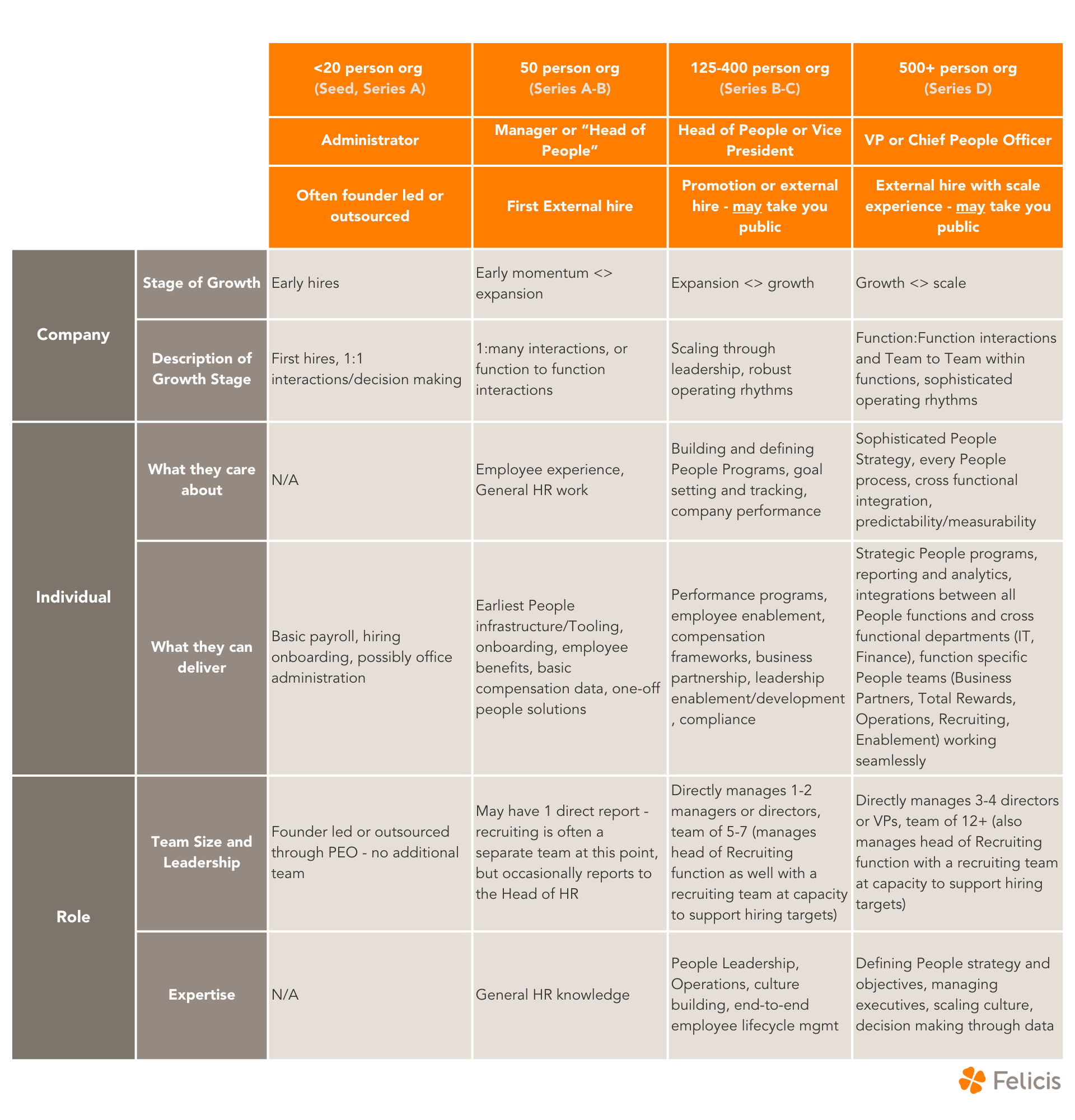

People

C-level People leaders appear the most likely to scale from mid-stage through IPO and most likely to be promoted internally. They are also the most delayed c-level functional executives with half coming at Series C or beyond. The people function appears to hire a mid level manager before Series B to manage the People function and hires a C-level later than many other functions. This is also the one function that seems to occasionally not hire a C-level executive

- 75% of companies had a People person by Series B, most common title People Operations/ People Operations Manager

- 50% of companies hired a C-level leader at Series C or beyond

- 30% of companies hired a C-level People leader at Series D or beyond

- 15% of companies had a C-level leader in place by Series D that took them through IPO

- Almost 10% of CHROs were promoted internally to C-level and remained through IPO or latest funding round

- 15% of companies never had a c-level People executive and reply on VP or SVP of People

How this may look in practice

(This is directional and not a one-size-fits-all representation)

Appendix

Companies include: Stripe, Okta, Databricks, Confluent, Snowflake, Airbnb, Pinterest, Uber, Canva, Chime, Plaid, ServiceTitan, Hopin, Atlassian, Zoom, Crowdstrike, Cloudflare, Zendesk, Adyen, Shopify, MongoDB, Twilio, Zscaler, Hashicorp, Slack, Coinbase, Datadog, uiPath,Anduril, Carta

.png)